How Much Does Moving from Prototype to Production Really Cost for Hardware Startups?

How Much Does Moving from Prototype to Production Really Cost for Hardware Startups?

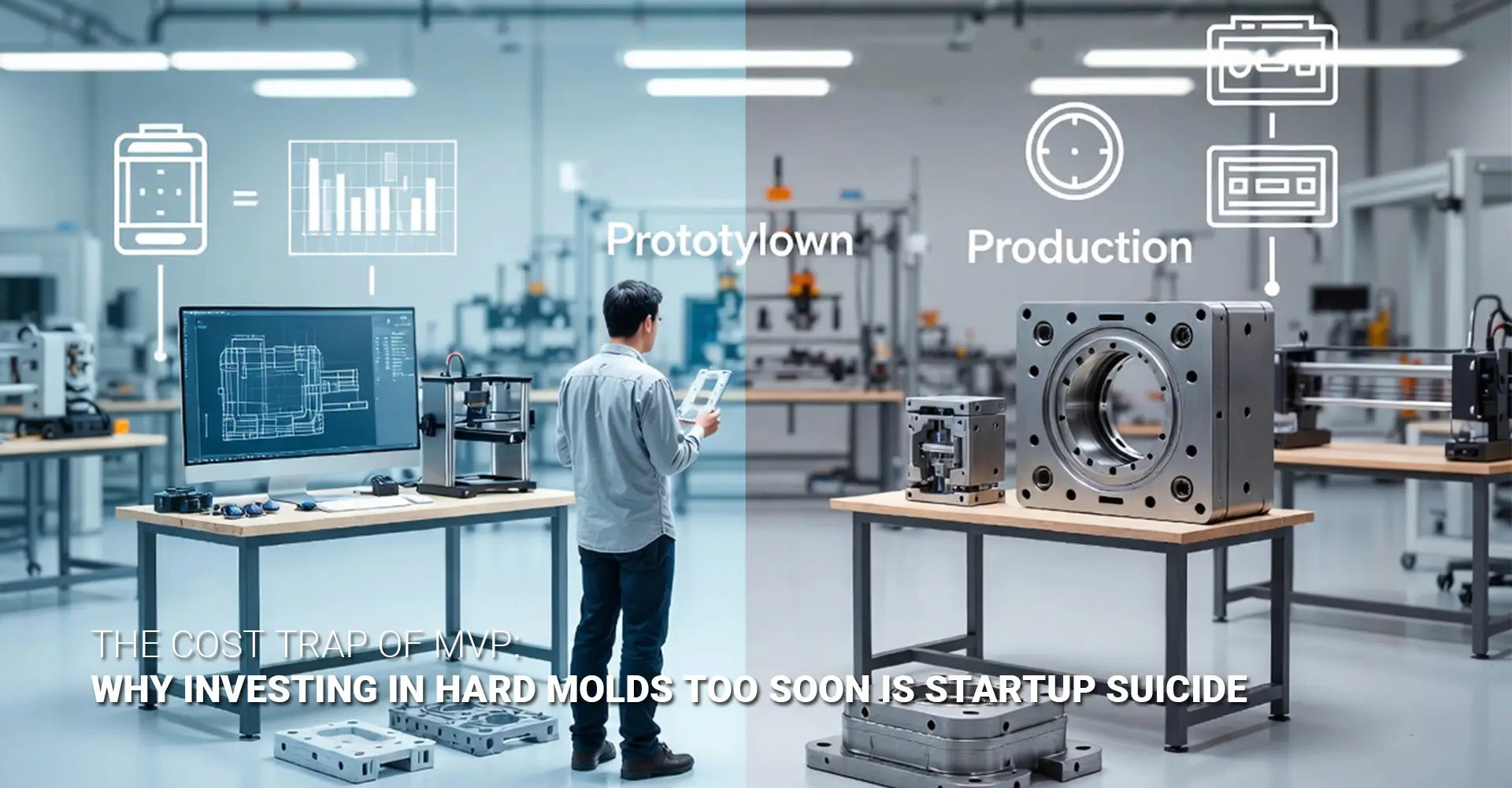

Every hardware founder faces the same gut-wrenching moment: your prototype works beautifully in the lab, early testers love it, and now you need to figure out how to make hundreds or thousands of units without burning through your runway. The leap from prototype to production isn't just a manufacturing challenge—it's a financial minefield where a single wrong decision about tooling can cost you $20,000, six months of runway, and sometimes your entire startup. Understanding the real costs, trade-offs, and risks of this transition is the difference between scaling successfully and becoming another cautionary tale in hardware entrepreneurship.

Hardware startups face a critical dilemma when scaling from rapid prototyping to production volumes: commit early capital to expensive hard tooling for lower per-unit costs, or maintain flexibility with higher-cost, on-demand manufacturing methods while you validate product-market fit. This decision directly impacts your burn rate, design iteration speed, and ability to pivot. Most founders underestimate the total cost of moving too quickly into production tooling, focusing only on per-unit economics while ignoring upfront investment, locked-in design risk, and the cost of getting it wrong.

The path from prototype to production involves far more than just manufacturing—it's a strategic financial decision that touches every aspect of your startup's health. In this guide, we'll break down the real costs at each stage, compare soft tooling vs hard tooling approaches, show you how to calculate true break-even points, and give you practical frameworks to decide when you're actually ready to commit capital to production tooling. Whether you're building consumer electronics, automotive components, or industrial equipment, these principles will help you avoid the most expensive mistakes hardware founders make.

Table of Contents

- What Changes When You Move from 10 Units to 1,000 Units?

- What's the Real Difference Between Soft Tooling and Hard Tooling?

- How Many Units Do You Actually Need to Justify a $20,000 Mold?

- Why Do So Many Hardware Startups Regret Cutting Molds Too Early?

What Changes When You Move from 10 Units to 1,000 Units?

The jump from making 10 prototypes to producing 1,000 units isn't a linear scaling exercise—it's a fundamental transformation in how you manufacture, finance, and manage your product. At prototype volumes, you're optimizing for speed and learning; every iteration teaches you something about design, materials, or user experience. But as you scale toward production volumes, the economics flip entirely: setup costs become amortizable, per-unit prices drop dramatically, but your upfront capital commitment and design lock-in risk skyrocket. Understanding this transition is critical to managing your prototype manufacturing cost effectively.

Three major cost drivers shift dramatically as you scale: per-unit manufacturing cost drops significantly due to economies of scale and process optimization; upfront investment in tooling, molds, or dies jumps from negligible to potentially tens of thousands of dollars; and working capital requirements for inventory multiply as you move from just-in-time prototype builds to batch production with longer lead times and minimum order quantities.

At prototype volumes under 50 units, your costs are dominated by labor, machine setup time, and premium pricing for low-volume manufacturing services. A CNC machined part might cost $150 per unit because the machinist spends three hours programming and setting up the machine, then only 30 minutes per part on actual cutting. Material waste is high because you're not optimizing nesting or buying in bulk. There's no tooling cost because you're using subtractive or additive processes that work directly from CAD files.

As you move toward 1,000 units, the economics transform completely. If you invest in dedicated tooling—whether injection molds, stamping dies, or custom fixtures—that upfront cost might be $15,000 to $50,000 depending on complexity. But now your per-unit cost might drop to $8–15 because cycle times are measured in seconds, not minutes, labor is mostly automated, and material waste is minimized through optimized tooling design. However, you now face minimum order quantities from material suppliers (often 500–1,000 kg of resin or metal), longer lead times (8–16 weeks for mold fabrication), and the need to tie up cash in inventory before you've sold a single unit.

The hidden costs multiply: you need warehouse space, inventory management systems, quality control processes for batch production, and working capital to float 60–90 days of inventory while you ship, invoice, and collect payment. For most hardware startups, this transition represents 60–80% of their seed funding—which is why timing this decision correctly can determine whether you reach your next funding milestone or run out of runway first.

What's the Real Difference Between Soft Tooling and Hard Tooling?

The choice between soft tooling and hard tooling represents one of the most consequential strategic decisions hardware founders make, yet it's often reduced to a simple per-unit cost comparison. In reality, this decision affects your design iteration speed, capital efficiency, time to market, and ability to respond to customer feedback. Understanding when to use each approach—and when to use a hybrid strategy—can save you tens of thousands of dollars and months of development time.

Soft tooling uses aluminum molds, rapid tooling techniques, CNC machining, or advanced 3D printing to produce parts with lower upfront investment, faster turnaround, and easier design modifications. Hard tooling uses hardened steel molds, multi-cavity dies, and fully automated processes to deliver the lowest per-unit cost at high volumes, but requires substantial capital investment and locks in your design for the life of the tool, which can span hundreds of thousands of cycles.

Soft tooling approaches include aluminum injection molds (good for 500–10,000 shots, costing $3,000–12,000), urethane casting from silicone molds (ideal for 25–100 parts at $500–2,000 per mold), CNC machining direct from CAD (unlimited design changes, $50–300 per part depending on complexity), and industrial 3D printing in production-grade materials (best for complex geometries, $20–150 per part). These methods share a common advantage: if you discover a design flaw after making 200 units, you can modify the tool for $500–3,000 or simply machine the next batch with updated CAD files.

Hard tooling means P20 or H13 steel injection molds that cost $15,000–80,000 but can produce millions of parts, progressive stamping dies for automotive components running $25,000–100,000 with cycle times under 5 seconds, or investment casting tooling for complex metal parts at $10,000–40,000. The per-unit economics are compelling: an injection molded part that costs $15 from an aluminum mold might cost just $2 from a steel mold at 10,000 units per year. But if you need to modify the design, you're looking at $5,000–20,000 in mold modifications or potentially scrapping the entire tool.

The real decision isn't soft versus hard—it's about timing and volume. Many successful hardware startups use a three-stage approach: start with CNC machining or 3D printing for the first 10–50 units while iterating rapidly based on user feedback; move to aluminum molds or bridge tooling for MVP volumes of 200–2,000 units once the design stabilizes; then invest in hard tooling only after achieving clear product-market fit and securing volume commitments that justify the capital outlay. This staged approach typically costs 15–25% more in total per-unit cost but reduces risk by 60–70% and preserves runway for genuine market validation rather than betting everything on an unproven design.

How Many Units Do You Actually Need to Justify a $20,000 Mold?

The break-even calculation for injection mold cost for startups seems straightforward: divide the tooling cost by the per-unit savings versus on-demand manufacturing, and you get the magic number of units where hard tooling pays for itself. But this simple math ignores the most important variables: time value of money, design risk, opportunity cost of locked capital, and the probability that your design will need changes before you hit that break-even volume. A complete financial model tells a very different story.

The basic break-even formula—tooling cost divided by per-unit cost delta—typically suggests that a $20,000 mold breaks even somewhere between 800 and 2,000 units, depending on the per-unit savings. But when you factor in the cost of capital, inventory carrying costs, the statistical likelihood of design changes, and the opportunity cost of spending that $20,000 on tooling versus customer acquisition or product development, the true break-even point often doubles or triples.

Let's walk through a real example. You're producing a housing for an electronics device. Via CNC machining, each part costs $28. With a $20,000 injection mold, per-unit cost drops to $4.50. Simple math says: $20,000 ÷ ($28 - $4.50) = 851 units to break even. But this analysis is dangerously incomplete.

First, add the time value of money. That $20,000 spent on tooling today could instead fund three months of runway at $6,500 per month burn rate. If you're six months from a Series A raise, preserving that runway might be worth 30–40% to your valuation dilution. Second, factor in the 8–12 week lead time for mold fabrication. During that time, you're not shipping product, not generating revenue, and not learning from customer feedback. The opportunity cost could be $15,000–25,000 in lost early sales and delayed learning.

Third, consider design change probability. Industry data shows 60–70% of hardware startups make at least one significant design change in their first 1,000 units shipped. If you need to modify the mold, add $3,000–8,000. If the change requires a new mold, you've lost the entire $20,000 investment. Assign even a 40% probability to meaningful design changes, and the expected cost of the mold jumps to $26,000–28,000.

Fourth, account for inventory carrying costs. With hard tooling, you typically need to order 500–1,000 units at a time due to setup economics. If your sell-through takes 6 months, you're carrying $2,250–4,500 in inventory (at $4.50 per unit) for an average of 3 months, costing you $100–150 in working capital expenses. Add the realistic break-even calculation: ($20,000 + $4,000 design change risk + $20,000 opportunity cost) ÷ ($28 - $4.50 - $0.15 inventory carrying cost) = 1,875 units.

Now the picture changes dramatically. You need nearly 1,900 units—not 850—to truly break even when you account for all costs and risks. For a hardware startup that has sold only 50 units to early adopters, this volume is 12–18 months away, assuming healthy growth. A better low volume manufacturing strategy is to stay with CNC or aluminum molds until you have at least 400–500 confirmed orders or strong evidence you'll hit 2,000+ units in the next 12 months.

The cash flow timing matters just as much as the total cost. Paying $20,000 upfront plus $4,500 for 1,000 units ($24,500 total) hits your bank account immediately. Paying $28 per unit via CNC spreads that cost over 6–12 months as you actually ship and collect revenue ($28,000 total), making it far easier to manage burn rate and runway. For early-stage startups, the $3,500 difference in total cost is often worth it to avoid the working capital crunch and design risk.

Why Do So Many Hardware Startups Regret Cutting Molds Too Early?

The pattern repeats itself across the hardware ecosystem: a founder gets excited about lower per-unit costs, raises a seed round, immediately cuts tooling, and then discovers critical design flaws after 200 units ship to customers. What follows is a painful scramble—mold modifications that take 6–8 weeks and cost $8,000, customer support headaches, returns and refunds, and worst of all, the realization that they burned $25,000 in capital and three months of runway on a design that wasn't ready. Understanding why this happens—and how to avoid it—is critical to surviving the prototype-to-production transition.

Premature tooling investment creates three compounding risks: design freezing before genuine validation with target customers at scale; capital trapped in tooling specifications that may be wrong, leaving no resources to fix problems when they surface; and extended time-to-market when inevitable changes require mold modifications or complete re-tooling. These risks hit hardest when startups confuse positive feedback from 10–20 friendly early

The root cause is usually overconfidence in design stability combined with pressure to hit per-unit cost targets that investors or advisors have fixated on. A founding team gets strong feedback from an initial pilot run of 25 units made via rapid prototyping, assumes the design is locked, and moves immediately to hard tooling to "get unit economics right." But those 25 units went to friendly users who are forgiving of minor issues, used the product in controlled conditions, and provided feedback on features—not on durability, edge cases, or real-world stress scenarios.

When the first 200 production units ship to paying customers, problems emerge: a mounting boss cracks under thermal cycling because the wall thickness was optimized for cost rather than real-world conditions; a snap fit that worked perfectly in prototypes fails 15% of the time in production because injection molding introduced slight warping that CNC parts didn't exhibit; or users discover that a button placement that seemed fine in testing is actually uncomfortable during daily use. Each of these issues requires mold modification or, worse, a complete redesign.

The financial damage cascades. You've spent $22,000 on the mold, $3,000 on the first production run, and now you need to spend another $6,000 modifying the mold and $2,500 on a second production run to fix the issues. You're $33,500 into a product that you could have validated for $12,000 via CNC or aluminum bridge tooling for MVP, tested with 200 real customers, iterated based on feedback, and then invested in hard tooling with confidence. The $21,500 delta would have funded another four months of runway—potentially the difference between reaching your Series A or running out of cash.

Beyond the direct financial cost, premature tooling damages relationships with investors, customers, and your team. Investors see poor capital allocation and question your judgment on other decisions. Customers who received defective units lose trust and may not come back for a replacement. Your team burns out dealing with support issues and rush fixes instead of building the next product iteration. The opportunity cost of delayed learning is the biggest hidden expense: every month spent fixing avoidable tooling mistakes is a month you're not validating your next feature set, expanding into adjacent markets, or building a more comprehensive understanding of your customers' needs.

The startups that succeed follow a different pattern: they embrace higher per-unit costs in early stages as the price of validated learning. They make 50–100 units via CNC or 3D printing, ship to real customers in real conditions, collect detailed feedback on failure modes and user experience, iterate the design 2–3 times based on data rather than assumptions, then make another 200–500 units using aluminum molds or bridge tooling. Only after this validation cycle—often 6–9 months and 500+ shipped units—do they commit to hard tooling. Yes, their blended per-unit cost for the first 1,000 units might be $18 instead of $6. But they avoid the $20,000–40,000 in wasted tooling, maintain design flexibility through the highest-risk learning phase, and preserve capital for scaling what actually works.

A simple checklist can help you assess tooling readiness: Have you shipped at least 100 units to paying customers who don't know you personally? Have you collected systematic feedback on durability, fit, and user experience in real-world conditions? Have you done at least two design iterations based on customer data rather than internal assumptions? Do you have a validated forecast showing you'll hit 1,500+ units in the next 12 months? Can you afford to lose the tooling investment if your next round falls through or customer demand disappoints? If you can't answer yes to all five questions, you're not ready for hard tooling—and that's okay. For hardware startups, maintaining flexibility and preserving runway is far more valuable than hitting unit cost targets on an unvalidated design.

Many successful hardware companies in sectors like industrial machinery and automotive manufacturing have demonstrated that strategic patience with tooling decisions pays compound returns. They prioritize validated learning over premature cost optimization, treating their MVP tooling cost as an investment in de-risking the business rather than an expense to minimize. This mindset shift—from optimizing unit economics to optimizing learning velocity and capital efficiency—is what separates hardware startups that scale successfully from those that burn through their runway building the wrong thing with expensive tools.

Conclusion

The transition from prototype to production is one of the highest-stakes decisions hardware founders make, with implications that ripple through every aspect of your startup's financial health and strategic positioning. The prototype to production cost calculation is never just about per-unit economics—it's about managing risk, preserving runway, maintaining design flexibility, and timing your capital commitments to align with validated learning rather than hopeful projections.

The startups that navigate this transition successfully follow a disciplined approach: they resist the temptation to optimize unit costs before validating product-market fit; they view higher per-unit costs at low volumes as the price of optionality and learning rather than waste; they invest in hard tooling only after shipping hundreds of units to real customers and collecting systematic feedback on design stability; and they structure their manufacturing strategy to preserve maximum runway while gathering the data needed to make confident scaling decisions.

Before you write a check for that $20,000 mold, ask yourself: Have I truly validated this design with enough customers under real-world conditions? Can I afford to lose this investment if my assumptions are wrong? Am I optimizing for the right metric—learning velocity and capital efficiency, or premature unit cost reduction? For most early-stage hardware startups, the answer is to stay nimble, stay flexible, and invest in tooling only when you have evidence—not just confidence—that you're ready to scale.

Your startup hardware manufacturing costs in the first 1,000 units will be higher if you follow this approach, but your probability of success will be dramatically higher. In hardware, as in most startups, the companies that win aren't the ones with the lowest unit costs in year one—they're the ones that are still around in year three because they managed capital wisely, learned quickly, and didn't bet the company on tooling before they were ready.

External Links Recommendation

[MVP tooling cost][^1]

[soft tooling vs hard tooling][^2]

[low volume manufacturing strategy][^3]

[startup hardware manufacturing costs][^4]

[injection mold cost for startups][^5]

[bridge tooling for MVP][^6]

---

[^1]: Understanding MVP tooling costs can help you budget effectively for your project and make informed decisions.

[^2]: Exploring this topic will clarify the advantages and disadvantages of each, aiding in your manufacturing decisions.

[^3]: Understanding this strategy can help optimize production and reduce costs for startups.

[^4]: Exploring this topic will provide insights into budgeting and financial planning for new hardware ventures.

[^5]: Understanding the costs involved can help startups budget effectively and make informed decisions.

[^6]: Exploring this concept can provide insights into efficient prototyping methods for startups.